NYSE

The New York Stock Exchange is the largest securities exchange in the world, hosting 82% of the S&P 500, as well as 70 of the biggest corporations in the world. It is a publicly-traded company that provides a platform for buying and selling over nine million corporate stocks and securities a day.

- In 1792, the NYSE was established at 68 Wall Street where 24 brokers and merchants outlined the rules for trading securities in the Buttonwood Agreement.

- The organization was initially named New York Stock & Exchange Board. It became the New York Stock Exchange in 1863.

- In 1971, NYSE became a not-for-profit corporation, and in 2006, a publicly-traded company. It was also during this time when traders and the public started using an electronic system to trade stocks. In 2007, NYSE merged with Euronext, and in 2008, NYSE acquired the American Stock Exchange. The Intercontinental Exchange later purchased the NYSE

Trading on the NYSE:

- All trades on the New York Stock Exchange follow a continuous auction format. Brokers trade stocks as buyers and sellers auction securities for the best price.

Though famous for its trading floor, most stock transactions are now done electronically, with computers matching buyers and sellers.

- Despite most transactions now happening through electronic platforms, the NYSE is still a hybrid market. This allows stockbrokers to send orders through either the electronic platform or to the trading floor where orders are carried out by floor brokers.

Opening and Closing Bells:

The NYSE originally used a gavel to signal the start and end of trading, but in 1870, it switched to a Chinese gong. When it moved to its present location, the gong was replaced by a brass bell. The opening bell rings at 9:30 a.m. Eastern Time, while the closing bell can be heard at 4:00 p.m.A significant part of the stock exchange's brand, the opening and closing bells are also used to mark a financial-related event or celebrate an important event in New York City. It is an honor to be invited to ring the bell on the NYSE.

The New York Stock Exchange is the busiest and most important financial market in the world. Its stocks are traded by investors worldwide.

Easily the most important landmark on Wall Street, the stock exchange practically created the Financial District by marking the neighborhood as an area of business. Wall Street was actually named for a real wall, built by Dutch settlers to keep out British forces. This wall served as an unofficial trading post for residents, beginning the business traditions that would continue in this same location for hundreds of years.

When the main building was built in 1903, it impressed everyone with its size and majesty. The opening solidified the prominence of the New York Stock Exchange and all but guaranteed that Lower Manhattan would be a neighborhood of commerce.

The Buttonwood Tree:

It all started on May 17, 1792, when 24 brokers and merchants met under a buttonwood tree.

At the time, this tree was the tallest thing in Lower Manhattan, which, in retrospect, is a pretty appropriate setting to sign an agreement that would grow to play a very significant role in both the United States and global economies.

It was under this tree that these two dozen individuals signed the Buttonwood Agreement, establishing the grounds for trading at what was then called the New York Stock & Exchange Board. That name was shortened in 1863 to what we know today: the New York Stock Exchange.

To commemorate the document that led to its creation, the stock exchange planted a new buttonwood tree out front. The tree isn't nearly as full or towering as the original, but it's the symbolism that counts.

The Trading Floor:

The NYSE has always been an exciting place with exciting things happening every minute. Up until the early 2000s, the trading floor was full of people frantically running around, shouting numbers and exchanging hand signals with each other.

The exchange even had a special trading floor clock without hour markers. There are only five-minute markers, because each trader had just five minutes to trade their stock. Talk about pressure!

You can imagine how hectic it got in there since, up until the past few decades, all the trading was done on the trading floor itself. These days, with the rapid advances in technology and the internet, most trades around the globe have transitioned to electronic systems. The NYSE is becoming one of the few remaining trading floors where humans are still actively trading in person.

Now, that doesn't mean it's been abandoned. In fact, in 2007, the exchange adopted a hybrid model that combines electronic and floor-based trading.

Currently, there are approximately 500-1,000 people trading on the floor each day. About 33 media outlets come in and out of the building every day to broadcast from the NYSE floor.

The Bell:

Every weekday, the opening bell of the NYSE is rung at 9:30 a.m. to mark the start of the day's trading.

The closing bell is then rung at 4 p.m. to mark the end.

When the guest ringing the bell fails to ring it for the acceptable amount of time — 10 seconds for the opening bell and 15 seconds for the closing bell – it's not uncommon for the floor to erupt into boos (they take their bell ringing very seriously).

If you are lucky enough, and happen to show up on the right day and time, you just might hear it emanating from outside.

https://www.thewallstreetexperience.com/blog/experience-the-nyse

- The largest equities based exchange in the world, based on the total market capitalization of its listed securities.

- Formerly run as a private organization, the NYSE became a public entity on March 8, 2006, following the acquisition of electronic trading exchange Archipelago.

- In 2007, a merger with Euronext - the largest stock exchange in Europe - led to the creation of NYSE Euronext.

- They were later acquired by Intercontinental Exchange, Inc. (ICE), the current parent of the New York Stock Exchange.

- The "Big Board" is the nickname for the NYSE.

- The main building located at 18 Broad Street and the one at 11 Wall Street were both designated historical landmarks in 1978.

- There is one trading floor for equities and another for the NYSE American options exchange.

The NYSE is the world's largest stock exchange by market capitalization, estimated to be $26.64 trillion as of August 2021

- The NYSE relied for many years on floor trading only, using the open outcry system. Many NYSE trades have transitioned to electronic systems relying mainly on designated market makers to conduct both the physical and automated auctions. Quotes offered by DMMs are on par with what floor traders and other market participants offer.

- The NYSE is open for trading Monday through Friday from 9:30 a.m. to 4:00 p.m. ET. The stock exchange is closed on certain U.S. holidays. When these fall on a Saturday, the NYSE is sometimes closed the preceding Friday. When holidays fall on a Sunday, the NYSE may be closed the following Monday.

- The opening and closing bells of the exchange mark the beginning and end of the trading day. The opening bell is rung at 9:30 a.m. ET, and the closing bell is rung at 4:00 p.m. ET, closing trading for the day.

Trading days did not always begin and end with a bell—the original signal was actually a gavel. During the late 1800s, the NYSE changed the gavel to a gong. The bell became the official signal for the exchange in 1903 when the NYSE moved to 18 Broad Street.Prior to 1995, the exchange's floor managers rang the bells. But the NYSE began inviting company executives to ring the opening and closing bells on a regular basis, which later became a daily event. The executives are from companies listed on the exchange, who sometimes coordinate their appearances with marketing events

The New York Stock Exchange passed the milestone of 1 million shares traded in a single day in 1888. By 1997, 1 billion shares were changing hands on the NYSE during a normal business day.

- The Exchange originated in 1792 as a mechanism for handling the first Issues of government securities and in time its quotations became the standard of the country.

- The Exchange assumed its position as the Nation's principal securities market early in the 19th century, about the same time that New York City surpassed Philadelphia as the country's chief financial center.

- During succeeding decades the Exchange grew steadily in size, prestige, and number and volume of issues traded. Eventually, it became the centerpiece for that great symbol Wall Street.

Over the years the New York Stock Exchange has occupied many structures:

- It made its headquarters in the Tontine Coffee House until 1817

- In rented space at 40 Wall Street from 1817 to 1819

- In three temporary locations from 1819 to 1827

- In the Merchants' Exchange from 1827 until it was destroyed by fire in 1835

- In three more temporary locations from 1835 to 1842

- In the Second Merchants' Exchange from 1842 to 1854

- In the Corn Exchange Bank building from 1854 to 1856

- In the Lord's Court building at William and Beaver Streets and Exchange Place from 1856 to 1865.

Since 1865, with the exception of 2 years between 1901 and 1903, the Exchange has occupied all or part of the site of its present location.

The 10-story building at 18 Broad Street was completed in 1903. It was designed in the NeoClassical style by George B. Post, and built of white Georgia marble. It's most famous facade features pediment statuary by John Q. A. Ward.

The building at 11 Wall Street was built in 1922, and the building at 20 Broad Street completed in 1954. Together, these three buildings fill the block bounded by Wall Street on the north, Broad Street on the East, Exchange Place on the south, and New Street on the west.

https://www.google.com/maps/place/New+York+Stock+Exchange

When originally opened, it was the first air conditioned space in NYC. At the height of the manual trading market, the NYSE expanded to include 5 trading floors, but technology now allows the Original 1903 Trading Floor to now house all of the Exchange's equity trading.

The New York Stock Exchange Trading Floor is the last major physical trading floor in the world, which allows the Exchange to operate its unique Designated Market Maker model. It is now home to 35 global news entities that broadcast live daily from the floor and one of our unique event spaces for evening events.

Since its 1792 founding by 24 brokers, the New York Stock Exchange has been the place you went to make money. But until 1880, it was done quietly, with well-behaved traders sitting in seats and bidding on offerings in an orderly manner. By the roaring '20s, the Exchange evolved into a madhouse where insider trading was not frowned upon.

During the 1930s, insider trading was made illegal and Merrill Lynch soon popularized stock-market investing for average Americans. Wall Street became a pop-culture phenomenon. Visiting the NYSE was a photo-op for politicians, celebrities and business-world elites.

In 1976, Alice Jarcho emerged as the first female to regularly trade on the floor, and the men didn't make it easy for her. The atmosphere was raucous and rife with practical jokes.

Since 2002, the NYSE has condensed from five rooms to one with two trading floors. While there used to be some 5,000 floor brokers and support staff during the Exchange's 1990s peak, the number is now closer to 500, according to an NYSE spokesman. The audible roar of business transacting is gone.

| NYSE Timeline | |

|---|---|

| https://nypost.com/2020/02/15/how-the-macho-nyse-trader-became-an-endangered-species | |

| 1792: Underneath a buttonwood tree, near the southern tip of Manhattan, 24 brokers and merchants sign the Buttonwood Agreement. It is a contract by which they agreed to trade securities in exchange for commissions. | |

| 1817: Rooms at 40 Wall Street served as headquarters for the New York Stock Exchange. | |

| 1867: The invention of the stock ticker made it possible for investors to keep track of stock prices, even from locations outside of the New York Stock Exchange. Serious traders got offices near the exchange, since proximity led to more accurate quotes on the tape. | |

| 1929: On October 24, 1929, known as Black Thursday, the stock market crashed. Fortunes were lost and lives were ruined. Since there were no TVs and few telephones, crowds gathered outside the Exchange. People were hoping to find out what happened to their money. | |

| 1954: Twenty-five years after Black Thursday, the Dow Jones industrial final went above its high of 1929. | |

| Early-1980s: The NYSE trading floor dress code requires the wearing of jackets. Tired of getting their expensive sport coats marked up with pens, traders the iconic cotton/poly blend "traders jackets" that have since become ubiquitous on the floor. | |

| 1987: Following a wildly profitable streak, the Dow went down by 22.61 percent. This lives on as the greatest one-day drop in the Dow's history. Anticipating a disaster, the Exchange's managing director of floor operations put a hand to his chest – which he characterized as the "gladiator's salute." He said that it means, "We who are about to die, salute you." By day's end, traders were hobbling around the litter strewn trading floor and investments were decimated. | |

| 1999: The Dow Jones industrial crossed 10,000 for the first time. It was met with a ton of hype. New York Stock Exchange chairman Richard Grasso tossed "Dow 10,000" baseball hats onto the trading floor. Charles Schwab insisted, "It's just a number." | |

| 2008: Traders on the floor of the New York Stock Exchange freaked out as the Dow dropped 777 points, contributing to a global sell-off of securities that led to the Great Recession. Traders stood in shock, with hands over mouths as they watched the market collapse. | |

| 2020: The Dow crossed 30,000. Hats with that magic number are visible on the trading floor. But with the exchange having shrunk precipitously and most of the action taking place electronically, the frenzy seems muted. Those watching at home — as so many former floor traders are — can now buy their Dow 30,000 hats on Etsy. | |

https://nypost.com/2020/02/15/how-the-macho-nyse-trader-became-an-endangered-species

On May 17, 1792, two dozen New Yorkers met under a tree to talk about Revolutionary War debt. That little conversation spawned the behemoth we have all come to fear and loathe, yet depend on for tax revenue and retirement stability: the New York Stock Exchange.

After suffering the indignity of British occupation during the Revolutionary War, New York was on the upswing in the 1780s. On its way to passing Philadelphia as the largest city in the new United States, New York became the nation's capitol in 1785, and George Washington was inaugurated in New York in 1789.

The young government faced two thorny questions:

- Where would the nation's permanent capital be located

- What would become of war debts from the Revolution?

Though seemingly disparate issues, frenemies Thomas Jefferson and Alexander Hamilton worked out a compromise on a Manhattan sidewalk outside of Washington's house. Jefferson wanted the capital in the south, preferably on the Potomac River, and Hamilton wanted federal assumption of war debts to create a strong central government. In 1790, construction began on Washington D.C, the capitol was temporarily moved to Philadelphia, and the federal government was now the proud owner of state war debt.

To pay off these debts, Congress issued $80,000 worth of government stocks, but the investor class's appetite was tepid. Potential buyers were concerned about unloading the stocks down the road and fluctuating prices. Traders met informally in coffee shops and law offices, but there was no method to the madness. That's why on May 17, 1792, 24 merchants got together under a buttonwood tree at 68 Wall Street to draw up plans for a New York Stock Exchange, a meeting forever known as the Buttonwood Agreement.

The main outlines of the agreement were that members of the Exchange would only trade with each other, and commission's would be set at .25%, bringing stability to the trading of securities, most of which were Revolutionary War debts. Stock values were set according to eights (i.e. 34 3/8) according to prevailing method in Europe, itself following the Spanish standard for dividing silver dollars by eights.

https://janos.nyc/2015/05/18/today-in-nyc-history-the-birth-of-wall-street-1792

May 17, 1792 under the tree 24 stockbrokers and merchants signed the so-called Buttonwood Agreement, establishing the parameters for trading in the first incarnation of the New York Stock Exchange.

They agreed that they'd only trade with each other and represent the interests of the public, which meant that the confidence that they had in each other was the confidence that they had in the market. In other words, they wouldn't have to be worrying about selling bad stock or competition over commission rates, so the prices charged would reflect the value of the stock, not some other factor.

The exact text reads:

We the Subscribers, Brokers for the Purchase and Sale of Public Stock, do hereby solemnly promise and pledge ourselves to each other, that we will not buy or sell from this day for any person whatsoever, any kind of Public Stock, at a less rate than one quarter per cent Commission on the Specie value and that we will give a preference to each other in our Negotiations. In Testimony whereof we have set our hands this 17th day of May at New York. 1792.

The trades they made at the time were what would be considered commodities trading.

In the late 1700s, available stock was limited to insurance companies, the Bank of New York, the First Bank of the United States and "Hamilton Bonds" that Alexander Hamilton had decided to issue to deal with America's Revolutionary War debt. (The system was considered risky and criticized for making the wealthy wealthier.)

The agreement was an attempt to establish some rules after the 1792 financial panic, at which point there had been no rules or safeguards, and a lot of deals were reneged on. The panic had been instigated by the actions of the speculator William Duer, who borrowed to make trades until he found that he couldn't borrow anymore.

https://time.com/4777959/buttonwood-agreement-stock-exchange

Little more than a tiny sycamore planted in the sidewalk, the Buttonwood Tree stands in stark contrast to the enormous American flag and Roman facade of the imposing New York Stock Exchange (NYSE) building behind it. For years, it has been trying to outgrow its hole in the concrete but to no avail. Nevertheless, despite its short stature, the tree symbolises the very formation of the NYSE; behind it is a plaque which reads "central market place beneath for purchase and sale of securities was founded in 1792 by merchants who met daily beneath a buttonwood tree that grew nearby." This group of merchants was formalized by the "Buttonwood Agreement" although they did not really become financially active until after the War of 1812.

Interestingly enough, when traders have been at the Stock Exchange for twenty-five years, they are immediately invited to join a group called the Buttonwood Club. Although there are no official privileges, members are entitled to bragging rights and a numbered pin which can be worn on the vest.

https://untappedcities.com/2013/08/22/getting-into-roots-of-manhattan-through-history-famous-trees

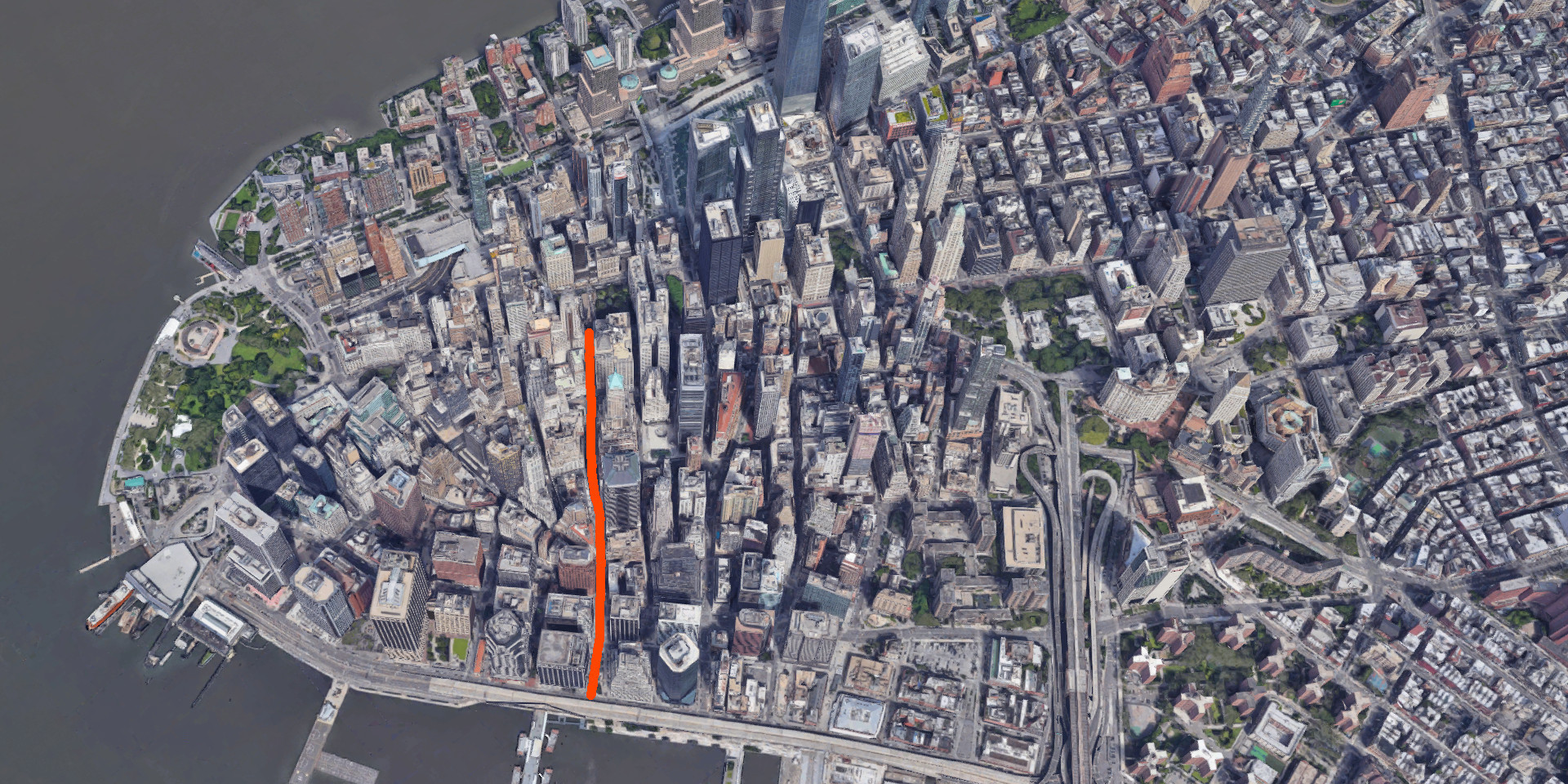

Wall Street:

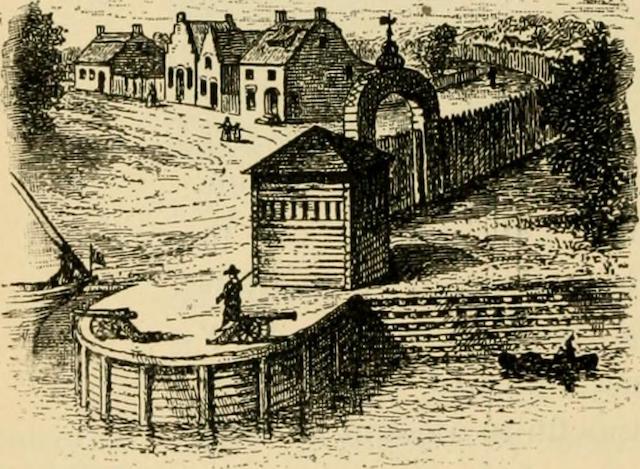

Named for an actual wall during the days of the Dutch when New York was known as New Amsterdam.

The Dutch originally built a wooden palisade in 1644 in defense of Indian attacks.

In 1653, New Amsterdam was chartered as a official Dutch city. That year they build a sturdier wall because the Dutch feared attacks not just from Indian tribes, but from the European colonies of Connecticut, Massachusetts and New Haven!

In 1653 the war between England and the Netherlands threatened the remote and undefended new city. The Dutch intended to launch ships from New Amsterdam harbor in battle against the English. As a result, the English colonies up north were sure to retaliate, either by sea or over land, possibly teaming with hostile Indian forces, down through undefended Manhattan island.

The barrier was constructed out of earth, rock, and 15 feet timber planks. Including brass cannons and two sturdy gates — one at today's intersection of Wall and Broadway for land, the other at Wall and Pearl Street (a water gate and access to a ‘river road').

15 years later the British took over New Amsterdam in 1664 and renamed it New York, but the wall still remained, becoming more a relic than a serious defense.

By the turn of the century, the fear of land attacks had almost completely subsided and the city was beginning to feel crowded and in 1699 the wall was torn down.

https://www.boweryboyshistory.com/2017/02/building-wall-wall-street-got-name.html

https://www.google.com/maps/place/Wall+St,+New+York,+NY

In 1868, the NYSE offered 1,060 seats that could be bought and sold by its holders. The number of seats grew to 1,100 and prices were fixed at $4,000, roughly over $100,000 in 2019 figures.

In the 1920s, a time of rampant social, economic, and political change in America, the NYSE experienced huge growth, and the price of a seat on the exchange reached $625,000. When the market crashed on October 24, 1929, the price fell to $68,000. In 1942, shortly after the end of the Great Depression, a seat cost a mere $17,000. More changes were to come a few decades later in the 1970s. At the time, the NYSE members were allowed to lease—rather than sell—their seats to qualified non-member brokers.

NYSE membership hit a $4 million record in 2005:

On December 1, 2005, a single membership was sold at $4 million.

These memberships let buyers trade on the floor of the stock market, otherwise known as a seat on the exchange.

The End of Members Only Seats:

In 2006, the days of "owning a seat" on the exchange ended when the NYSE became a for-profit organization and its private membership disbanded.

The remaining 1,366 NYSE seat owners profited from the sale, each receiving 80,177 shares in the new public company, $300,000 cash, and $70,571 in dividends.

The NYSE is owned, as of Sept. 2019, by Intercontinental Exchange (ICE), which bought it for over $10 billion in 2013.

One-year licenses in the public company are now offered for purchase, and these are transferable if the company that holds the license is sold. As of 2019, much of the trading on the NYSE is digital rather than physical, and the exchange floor, while still home to some traders, is considerably less crowded than it used to be.

https://www.google.com/maps/place/New+York+Stock+Exchange